Get the free ph annex b sworn form

Show details

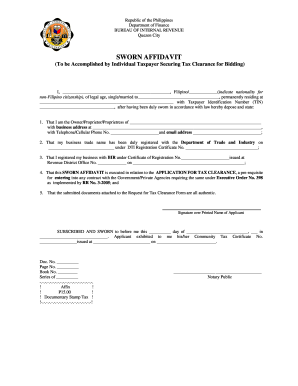

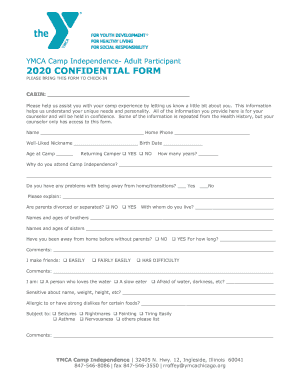

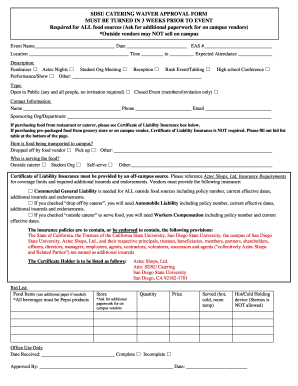

Annex B Taxpayer-user s Sworn Statement I, (Name of Taxpayer), (Nationality), of legal age designated (Position) of (Name of Company/Corporation), with business address at, do hereby certify the following:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bir tax sworn form

Edit your bir sworn form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sworn bir declaration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing bir declaration sworn online

To use the professional PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sworn bir statement form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out declaration sworn bir form

How to fill out PH Annex B Taxpayer-User's Sworn Statement

01

Obtain the PH Annex B Taxpayer-User's Sworn Statement form from the appropriate government agency or website.

02

Fill in your personal information at the top of the form, including your full name, address, and taxpayer identification number.

03

Provide details about the specific transaction or activity for which the statement is being filled out.

04

Indicate the type of taxes applicable to your circumstances, if required.

05

Review the form for accuracy and completeness.

06

Sign and date the form to certify the information provided is true and correct.

07

Submit the completed form to the relevant tax authority as instructed.

Who needs PH Annex B Taxpayer-User's Sworn Statement?

01

Individuals or entities engaged in transactions that require tax compliance, such as businesses or self-employed persons.

02

Taxpayers claiming deductions or exemptions under relevant tax laws in the Philippines.

03

Anyone required to affirm their tax status or usage of tax credits.

Video instructions and help with filling out and completing ph annex b sworn form

Instructions and Help about bir form declaration

Fill

bir declaration form

: Try Risk Free

People Also Ask about annex a1 for job order

How to download BIR Form 2307?

How to Generate BIR Form 2307 | Form 2306 Click the excel icon to choose the excel template to be used. Click BIR Form 2307 to download the template. Open the template and take time to analyze the sample data. Again, DO NOT edit Row1 and DO NOT work directly in the template.

What is Annex A1 form?

Annex A1 - Application for Recognition or Recognition and Enforcement.

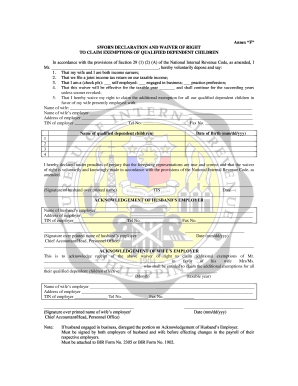

What is a sworn declaration form?

A sworn declaration (also called a sworn statement or a statement under penalty of perjury) is a document that recites facts pertinent to a legal proceeding. It is very similar to an affidavit but is not witnessed and sealed by an official such as a notary public.

How many copies of 2307?

3. Copies. The withholding agent has the option to issue only one BIR Form 2307 to cover more than one income payment to the same taxpayer even if subject to different rates. Taxpayers are still required to retain the hard copy of the said forms for validation during tax audit.

How do I download Form 2307?

How to Generate BIR Form 2307 | Form 2306 Click the excel icon to choose the excel template to be used. Click BIR Form 2307 to download the template. Open the template and take time to analyze the sample data. Again, DO NOT edit Row1 and DO NOT work directly in the template.

What is Annex b2 Bir?

ANNEX “B-2” INCOME PAYEE'S SWORN DECLARATION OF GROSS RECEIPTS/SALES.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in how to file sworn declaration bir?

The editing procedure is simple with pdfFiller. Open your bir annex d sworn declaration in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I edit bir annex 1 in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your sworn declaration of gross receipts, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I edit annex a 1 bir on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing sworn declaration bir inventory list.

What is PH Annex B Taxpayer-User's Sworn Statement?

PH Annex B Taxpayer-User's Sworn Statement is a document that taxpayers in the Philippines must complete to declare and certify their use of tax-exempt goods or services.

Who is required to file PH Annex B Taxpayer-User's Sworn Statement?

Taxpayers who utilize goods or services that are exempt from tax, particularly those under specific provisions of the tax code, are required to file the PH Annex B Taxpayer-User's Sworn Statement.

How to fill out PH Annex B Taxpayer-User's Sworn Statement?

To fill out the PH Annex B Taxpayer-User's Sworn Statement, taxpayers need to provide accurate information regarding their identity, the nature of the goods or services used, and the basis for claiming tax exemption, ensuring all details are correctly noted according to the provided guidelines.

What is the purpose of PH Annex B Taxpayer-User's Sworn Statement?

The purpose of PH Annex B Taxpayer-User's Sworn Statement is to provide a formal declaration of the use of tax-exempt goods or services by taxpayers, thereby serving as a compliance tool for tax authorities.

What information must be reported on PH Annex B Taxpayer-User's Sworn Statement?

On the PH Annex B Taxpayer-User's Sworn Statement, taxpayers must report their personal or business details, the description of the tax-exempt goods or services, justification for the exemption, and any other relevant data as required by the tax regulations.

Fill out your PH Annex B Taxpayer-Users Sworn Statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bir Forms Annex a1 is not the form you're looking for?Search for another form here.

Keywords relevant to sworn statement of gross receipts

Related to sworn bir form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.