PH Annex B Taxpayer-Users Sworn Statement free printable template

Fill out, sign, and share forms from a single PDF platform

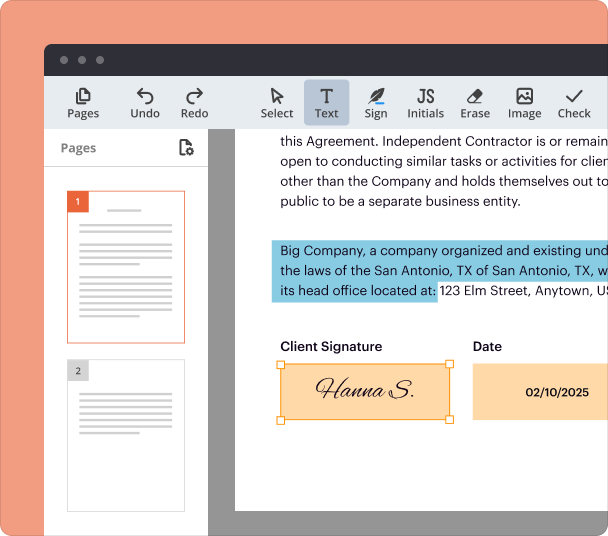

Edit and sign in one place

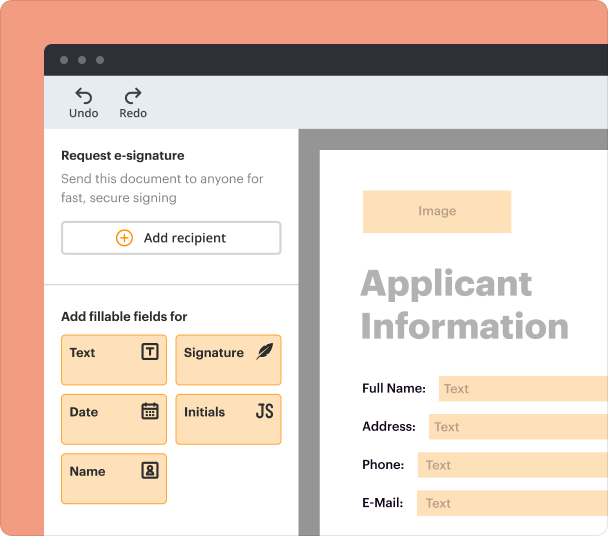

Create professional forms

Simplify data collection

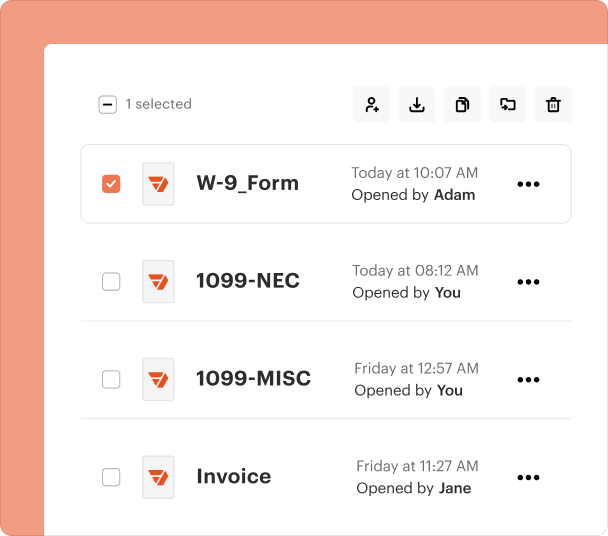

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

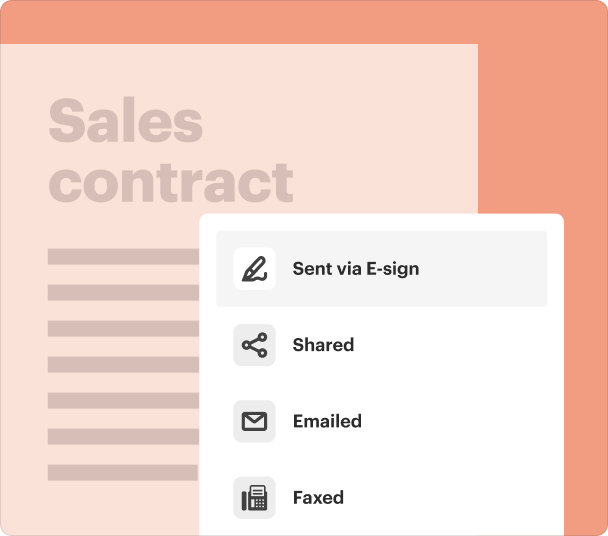

End-to-end document management

Accessible from anywhere

Secure and compliant

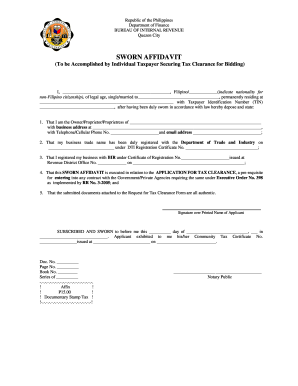

Understanding the PH Annex B Taxpayer-Users Form

What is the PH Annex B Taxpayer-Users Form?

The PH Annex B Taxpayer-Users Form is a sworn statement required for businesses in the Philippines to certify their registration and compliance with local tax regulations. It serves to affirm that the entity is fully aware and adherent to the cash register and invoice regulations, which are essential for valid invoicing and proper record keeping.

Key Features of the PH Annex B Taxpayer-Users Form

This form includes several key features. Primarily, it verifies the legal status of the business entity, outlines the specific requirements for issuing receipts or invoices, and mandates compliance with the National Internal Revenue Code for VAT-registered taxpayers. It also highlights the penalties for any violations, emphasizing the importance of adhering to tax laws.

Required Documents and Information

To complete the PH Annex B Taxpayer-Users Form, businesses must provide specific documentation and information. This includes the company's name, business address, National Tax Identification Number (TIN), and a copy of their registered ‘Printer’s Certificate of Delivery of Receipts and Invoices'. Ensuring all required details are accurately filled out is crucial for compliance.

How to Fill the PH Annex B Taxpayer-Users Form

Filling out the PH Annex B Taxpayer-Users Form requires careful attention to detail. Start by entering the company’s official name and address. Provide accurate information about the taxpayer’s nationality and position within the company. Next, affirm the registration of the entity and document the specified requirements for invoice issuance. Each section must be completed to avoid issues during submission.

Best Practices for Accurate Completion

To ensure accurate completion of the form, consider the following best practices. Verify the information with official documents, maintain clear and consistent formatting, and double-check all entries before submission. It may also be helpful to consult with a legal or financial adviser to ensure compliance with all applicable laws and regulations.

Common Errors and Troubleshooting

Common errors in filling out the PH Annex B Taxpayer-Users Form can include incorrect TINs, missing signatures, or inaccurate business addresses. To troubleshoot these issues, always cross-reference the filled details with official documentation before submission. Ensuring all fields are filled out comprehensively reduces the likelihood of rejections or fines due to non-compliance.

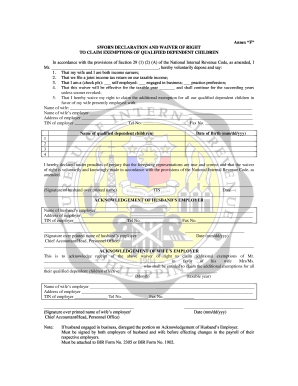

Frequently Asked Questions about bir sworn declaration form

Who needs to complete the PH Annex B Taxpayer-Users Form?

Any registered business entity in the Philippines that issues receipts or invoices must complete this form to comply with tax regulations.

What are the penalties for incomplete or incorrect submission?

Inaccurate or incomplete submissions can result in fines, additional scrutiny from tax authorities, or penalties under the National Internal Revenue Code.

pdfFiller scores top ratings on review platforms